The Ultimate Guide to Choosing the Best Payroll Software

Managing payroll efficiently is a critical task for any business, regardless of size. With growing regulations and complex tax requirements, relying on manual processes can lead to errors, employee dissatisfaction, and compliance issues. Businesses today are turning to technology to simplify this task, making payroll management faster, more accurate, and more secure. Investing in the right tools can save time, reduce stress, and ensure employees are paid correctly and on time.

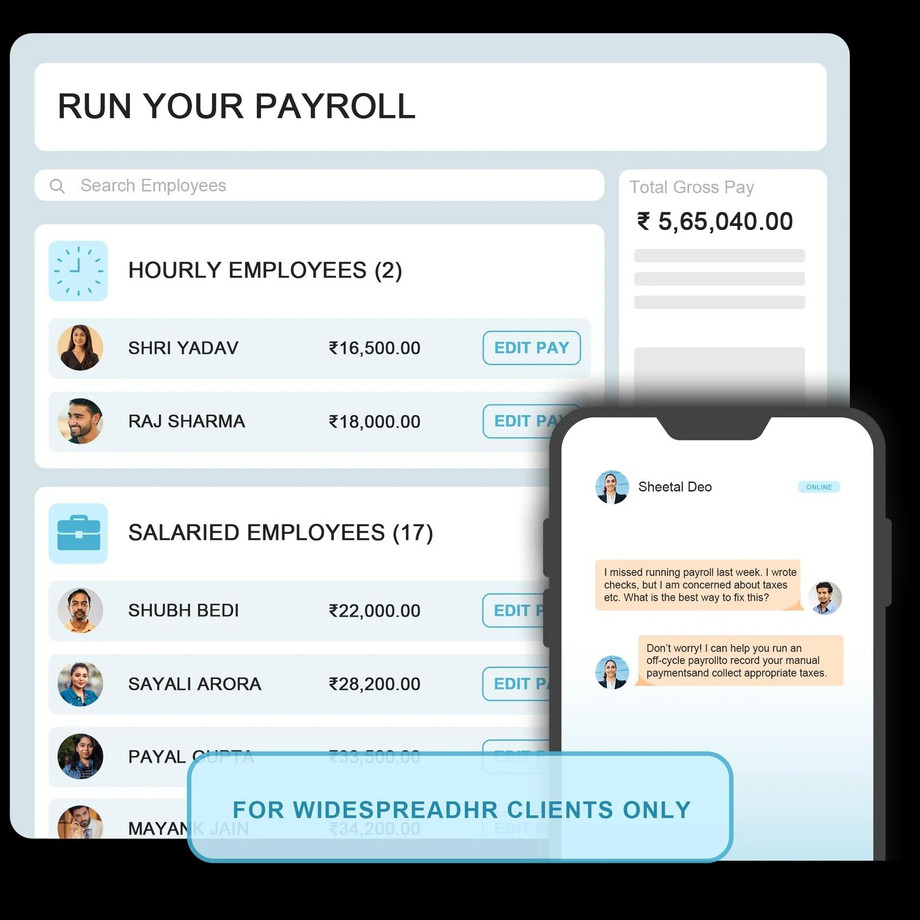

In recent years, the demand for best payroll software has surged as companies seek automated solutions that streamline calculations, tax filings, and reporting. Unlike traditional methods, modern payroll systems offer features such as direct deposit, real-time reporting, and compliance updates. By adopting advanced software, businesses can not only reduce manual errors but also provide employees with a seamless experience. Choosing the right system involves considering your company size, budget, and the specific features that best meet your needs.

One of the primary advantages of using online payroll services is the convenience of cloud-based access. Business owners and HR professionals can manage payroll from anywhere, at any time, without being tied to a physical office. These platforms also integrate with other business tools, such as accounting software, time tracking systems, and HR management platforms, allowing for a more cohesive workflow. Security is another significant benefit, as reputable providers offer encryption and regular updates to protect sensitive employee information.

When evaluating options for the best payroll software, it’s essential to examine their customer support, usability, and scalability. Small businesses may prioritize ease of use and affordability, while larger organizations might require advanced reporting and multi-state tax compliance. Many platforms offer free trials or demos, allowing decision-makers to test the software before committing. Reading reviews and consulting with other business owners can provide valuable insights into which solution is truly reliable and efficient.

Another factor to consider is the availability of online payroll services that handle tax filings and compliance automatically. This feature is particularly beneficial for companies that operate across multiple states or countries, where tax laws can vary significantly. Automation minimizes the risk of penalties and ensures accurate submissions, freeing HR teams to focus on other strategic tasks. Additionally, many of these services provide self-service portals, allowing employees to access pay stubs, tax documents, and benefits information independently.

Cost-effectiveness is often a deciding factor when choosing the best payroll software. While some solutions charge a flat monthly fee, others operate on a per-employee basis. Businesses should evaluate the total cost against the features offered, considering potential savings from reduced administrative work, fewer errors, and time saved. Investing in a robust system may have a higher upfront cost, but the long-term efficiency gains can make it worthwhile.

Finally, adopting online payroll services can enhance employee satisfaction and trust. When payroll is processed accurately and on time, employees feel secure and valued. Features such as automatic deductions, direct deposits, and clear reporting contribute to a transparent payroll experience. Moreover, employees can manage their payroll preferences and access important documents, which promotes engagement and reduces administrative queries.

In conclusion, selecting the right payroll solution is a crucial decision for any business. The best payroll software combines ease of use, accuracy, compliance features, and scalability, while online payroll services offer added convenience and security. By carefully assessing your business needs, budget, and long-term goals, you can choose a system that simplifies payroll management, saves time, and enhances employee satisfaction. Investing in the right software today will pay dividends in operational efficiency and peace of mind tomorrow.

Comments

Post a Comment